Unlocking The Potential Of The Turkish Natural Gas Market

Ibrahim Said Arinc

Over the past 37 years, the Turkish natural gas market has evolved amidst challenges, leading to complex circumstances. The 2022 Russian invasion of Ukraine and subsequent energy crisis have had varied impacts, posing risks of price hikes, accelerating decarbonization trends, and bolstering Türkiye's regional gas hub ambitions. The discovery of the Sakarya field in 2020 marks a pivotal shift from Turkey's traditional reliance on imports. With BOTAŞ's long-term contracts expiring by 2026, there's potential for significant market restructuring, including unbundling and new pricing policies. These recent dynamics introduce both challenges and opportunities, highlighting the need for a comprehensive approach to navigate current difficulties while leveraging emerging prospects.

Introduction

The Turkish natural gas market has experienced a challenging development and transformation over the past 37 years, resulting in promising and complex circumstances. The Russian invasion of Ukraine in 2022 and the energy crisis had diverse effects on the Turkish natural gas market, bringing the risks of price increases, faster decarbonization trends, and opportunities supporting Türkiye's regional gas hub plans. Furthermore, the discovery of the Sakarya field in 2020 marks a significant and unprecedented shift for the Turkish natural gas market, which has traditionally relied on imports. The expiration of BOTAŞ's long-term contracts by 2026 may create a new opportunity for a long-awaited market restructuring, including unbundling, a foreseeable pricing policy, and other market reforms. Hence, the recent external and internal dynamics have brought novel components that could either worsen the present challenges or provide a chance to adopt a new comprehensive

A Short Overview Of The Turkish Natural Gas Market: Past, Today And The Future

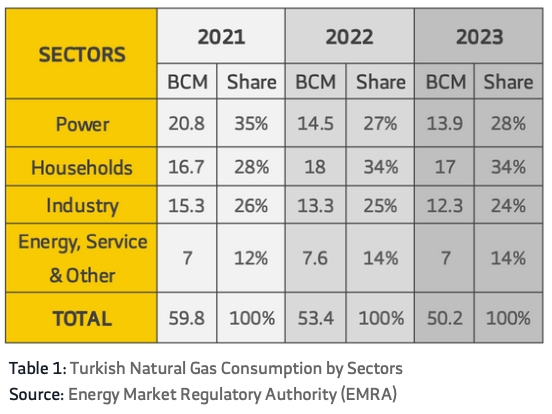

Since 1987, natural gas has contributed to the development of the Turkish economy and played an essential role in meeting the growing energy demand. In 2023, according to the Energy Market Regulatory Authority (EMRA), Türkiye consumed 50.2 billion cubic meters (BCM) of natural gas (See Table 1).[1] Türkiye is Europe ' s 4th largest natural gas market after Germany, the UK, and Italy.[2] In the last twenty years, natural gas power plants have played a crucial role in meeting the growing demand and offering less carbon emissions than coal power plants. Electricity generation from natural gas accounted for 20.88% of the national electricity supply in 2023.[3]

As of January 2024, all 81 cities and 836 residential areas are connected to the natural gas system.[4] According to the Natural Gas Distribution Companies Association of Türkiye (GAZBİR), 82% of the Turkish population has access to natural gas, and 71% are active gas users.[5] Until 2026, the EMRA anticipates the natural gas grid to be extended to 1,000 residential areas. With the grid extension investments, the active gas user population is expected to reach 71.5 million in 2026, which will be 80% of TURKSTAT' s base case scenario of the Turkish population in 2026.

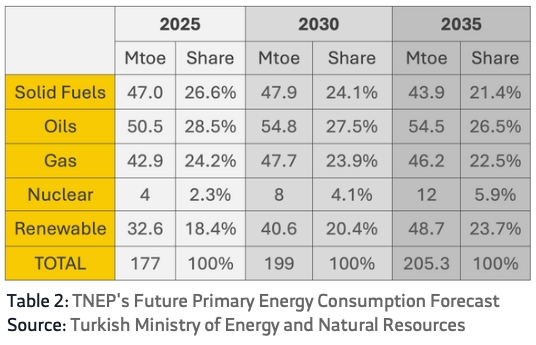

Inevitably, the national energy and emissions targets will have a direct impact on the future of gas demand. Turkish National Energy Plan (TNEP) projects a future natural gas consumption of 52 BCM (42,9 mtoe) in 2025, 58 BCM (47,7 mtoe) in 2030, and 56 BCM (46,2 mtoe) in 2035 (See Table 2)[6]. The projected levels of TNEP consumption forecast demonstrate that the recent years ' exponential growth in gas consumption is anticipated to give way to a steadier rise in the future, supporting the notion that the Turkish gas market is nearing maturity.

The challenges in implementing Natural Gas Market Law (NGML) No.4646, adopted in 2001, have been a long- standing topic of discussion, leading to complexities and uncertainties in the sector ' s development. NGML, aimed to liberalize the Turkish gas market, failed to unbundle BOTAŞ and limit its share in natural gas imports to under 20%. Although a portion of import contracts with Gazprom of BOTAŞ were transferred into private companies in 2007, and expired contracts of BOTAŞ were prolonged by the private companies in 2013, BOTAŞ maintained an average market share of 92.2% of total imports in the last five years.[7] The government' s price control policy, achieved via BOTAŞ' s gas sales, effectively sustains BOTAŞ' s market dominance. On the other hand, although NGML envisaged the unbundling of BOTAŞ until 2009, the unbundling efforts have been unsuccessful in creating a transparent and equitable natural gas market environment where separate entities operate. This situation highlights a lasting contradiction between the policy and its actual implementation.

The Turkish Gas Market After The Russian Invasion Of Ukraine In 2022: The Emerging Risks And Opportunities

1. The Higher Gas Import Prices And The Curse Of The Subsidy Policy

In Europe, the TTF of the Netherlands spot prices averaged an all-time high of USD 38/MBtu in 2022, nearly eight times the five- year average for 2016-2020.[8] The TTF prices stabilized in 2023 at USD 12 MBtu levels due to successful EU policy measures and favorable meteorological conditions. However, if the transit agreement between Russian Gazprom and Ukrainian Naftogaz does not extend beyond 2024, it could exert further pressure on gas prices in Europe. After 2026, due to the commencement of new LNG liquefaction plants and better supply conditions, OIES predicts European and Asian LNG prices may drop to USD 7-8/MBtu by 2029/2030.[9] On the other hand, before the energy crisis, the demand in the EU gas market was met by 80-90% long- term import contracts. IEA estimates that if no new long-term contracts are signed due to the uncertainty of natural gas in the future energy mix of the EU, the share of spot volumes is predicted to increase to more than 70% by 2030.[10] This risk makes EU gas markets more vulnerable to price fluctuations on a global scale, which can also be higher price risk for Türkiye, which imports a significant share of gas that is TTF-indexed.

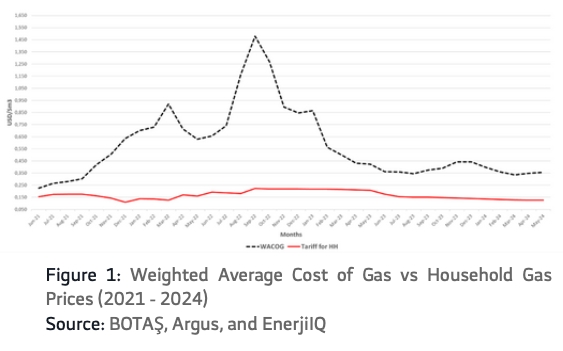

The immediate effect of the Russia-Ukraine war was the higher gas import bill for Türkiye as TTF and oil-indexed price hikes significantly burdened the Turkish economy. Historically, with some exceptional years, the Turkish government has pursued a subsidy policy via BOTAŞ to protect households, small-scale industry, and commercial gas users against gas import price increases. In general, the main issue with the subsidy policy lies in its indiscriminate support for all households, regardless of their income level. This situation leads to an unjust support mechanism and an inequitable distribution of public resources among citizens. The pricing mechanism applied for industrial and power sectors is also determined by a sui generis pricing policy that makes private entrepreneurs hesitate to take market risks. Between 2021 and 2024, the gap between the average import cost and the subsidized household gas sale prices created a historic burden on the Turkish Treasury (See Figure 1). According to data published by the Turkish Treasury, for 2021,2022, and 2023, BOTAŞ was funded (under authorization payments) by the government, exceeding 12 Billion USD in pursuing the subsidy policy. [11]

2. Türkiye To Become A Regional Gas Hub

In the Russia-Ukraine war, Türkiye has a balancing policy that contributes to reducing the conflict' s global outcomes. Türkiye played a crucial role in the Black Sea Grain Deal, which could have international repercussions. [12] Türkiye ' s commercial and political capacity to introduce the Anatolian Gas Centre (AGC)[13], which would establish a regional gas hub, could play a facilitative role in contributing to the REPowerEU' s gas supply diversification objectives and could be a reliable partner of Russia for natural gas sales to third countries. In this context, the tight gas market of the EU with the total phase-out of Russian gas imports is expected to give Türkiye a new supply outlet for Central and Southeastern European gas markets.

With the commissioning of the TANAP in 2018 and the TAP in 2020, Türkiye played a significant role in the realization of the Southern Corridor. As highlighted in REPowerEU, the EU and Azerbaijan agreed in July 2022 to export an additional 10 BCM/y to Europe, which enhances Türkiye’s regional role as a reliable route for the security of supply. Moreover, Türkiye became a significant transit route for Russian gas exports to Europe with Turkstream, which started to operate in 2020. If the transit agreement between Ukraine and Russia is not extended beyond 2024, the only route for Russian gas deliveries will be the Turkstream. In this framework, Russia and Türkiye made statements about establishing a gas trading center in Türkiye to export extra gas to European countries via the existing infrastructure.

On the other hand, Türkiye has invested heavily in upgrading its gas system to ensure energy security in the last decade. Türkiye increased its underground storage capacity from 2,8 BCM to 5,6 BCM in 2023, aiming to reach 10 BCM by 2026.[14] With two LNG terminals and three FSRU facilities, Türkiye has increased its nameplate LNG gasification capacity to 30,1 MTPA (41.5 BCM/y).[15] According to EMRA reports, the average utilization of LNG facilities over the past five years was 42,2%, indicating the idle capacity for further LNG imports.[16]

Extensive LNG gasification capacity provides the Turkish gas market flexibility for additional LNG imports and pipeline exports to Europe via interconnections of Greece and Bulgaria. By combining its indigenous production with imports via pipeline and LNG, Türkiye can provide gas to these regions, establishing itself as a regional gas hub. In this context, BOTAŞ signed gas supply agreements with Bulgaria, Hungary, Romania, and Moldova in 2023. In addition, Türkiye has also created a gas exchange market called OTSP, as well as the Turkish Natural Gas Reference Price (GRF) mechanism. The GRF serves as a benchmark price for the Turkish gas market and is calculated at OTSP. However, despite the government' s strong support, the volume of gas traded at OTSP accounted for only 1 BCM in 2023.[17]

Although Türkiye made significant progress in upgrading the natural gas system and issued comprehensive regulations, according to the European Federation of Energy Traders (EFET) assessment of 2023, the market still has development areas for becoming a liquid regional natural gas hub. In the EFET' s Review of Gas Hub Assessment, Türkiye received 9 points out of 20, and the GRF was not considered a reliable benchmark price for being a regional gas hub.[18]

3. Renewable Gas For The Turkish Gas Market

The EU, Türkiye ' s most significant export route valued at €95.5 billion[19], introduced the Carbon Border Adjustment Mechanism (CBAM), also called the carbon border tax, in 2023. The CBAM, which will be operational by 2026, is the EU' s instrument for encouraging cleaner industrial production in non-EU countries and setting a price on the carbon released while producing carbon-intensive goods entering the EU. An academic article estimated the future impact of CBAM on the Turkish economy to result in a 2.7% to 3.6% reduction in the country ' s GDP by 2030 under business-as-usual circumstances.[20] The Turkish industry sector will need cleaner energy to decrease its carbon footprint, and renewable gas might be a crucial option for hard-to-abate sectors.

In the TNEP, natural gas used by end-user sectors is envisaged to be blended with clean fuels such as hydrogen and synthetic methane to reduce emissions.[21] In this context, MENR announced Türkiye ' s Hydrogen Strategy in January 2023 as a component of the nation ' s 2053 Net Zero Targets. The Turkish energy minister announced that in the future, the share of hydrogen blended into natural gas will be 12% and synthetic methane 30%, starting from 2030 until the end of 2053.[22] Although global trends for decarbonizing natural gas systems emphasize the critical importance of biomethane, it is not explicitly considered in TNEP. However, according to ENGIE' s report on the biomethane potential of Europe by 2050, Türkiye is assumed to have a significant amount of biomethane potential of approximately 13 BCM/y, ranked third in Europe after Germany and France. [23]

New Dynamics In Gas Supply: The Year 2026 And The Sakarya Gas Discovery

Türkiye mainly imports natural gas via pipelines (72% of total imports five years average)[24], and the rest is received via LNG gasification terminals. Russian Federation has been the leading supplier since the establishment of the natural gas market. In recent years, Azerbaijan has increased natural gas supplies to Türkiye, while Iran has had a steady supplier profile for a long time. Importation via LNG terminals has increased the gas market' s flexibility to deal with demand fluctuations and pipeline delivery interruptions. LNG gasification facilities may offer idle capacity to maintain energy security or utilize this idle capacity for gas exports via interconnections.

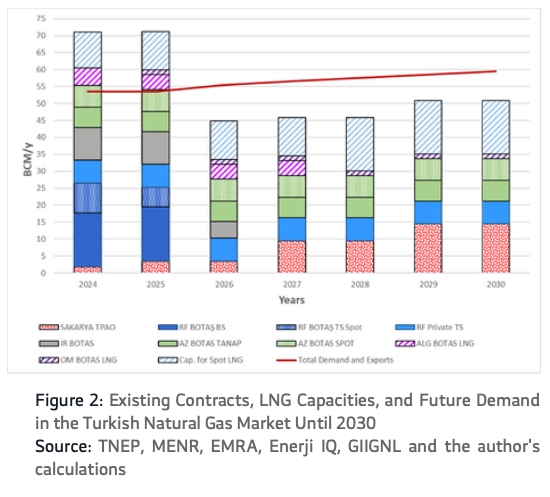

Furthermore, until the end of 2026, BOTAŞ' s long-term and short-term spot contracts with the Russian Federation and Iran will expire, constituting 55% of the existing import contracts. (See Figure 2). According to Enerji IQ, Turkish active gas import contracts are indexed to 40% TTF and 60% oil in 2024.[25] The increasing share of TTF-indexed contracts raises the vulnerability of the Turkish gas market prices, which will expose them to a further European energy crisis where the geopolitical risks are still high. By 2026, if the expiring contracts are not prolonged or substituted with new ones from alternative suppliers on favorable terms, the Turkish gas market may be exposed to higher global price risks with spot procurements.[26] Therefore, before 2026, Turkish policymakers should have a clear strategy for signing new contracts to mitigate the risks of uncertainty and energy security.

Before the discovery of the Sakarya field, Türkiye was 99% dependent on natural gas imports. Hopefully, the Sakarya field, with a 710 BCM reserve, will decrease the import dependency rate and contribute to the Turkish economy.[27] However, even if Sakarya production reaches a plateau level by the 2030s, the import dependency could still be at least 75%, leaving the gas market significantly dependent on natural gas imports and exposed to global price risks.

A New Vision For The Turkish Natural Gas Market

The Turkish economy has benefited from the natural gas market development over the past four decades. However, the recent energy crisis has shown that the Turkish economy has incurred significant costs due to the subsidy program, uncertainty, and an inadequate legal framework. In April 2023, NGML was amended to restructure BOTAŞ and the gas market. In the preamble of the amendment bill, the policymakers stressed the need for BOTAŞ to be restructured by the applicable legal framework to serve the nation ' s best interests while maintaining energy security and enhancing competition in the gas market. [28] With the amendment, BOTAŞ' s 20% market share restriction and new contract signing ban are lifted. The law also introduced transit and export-related transmission mechanisms to support the creation of a gas hub that enables future gas exports to neighboring regions and maintains gas supply security.

Nevertheless, due to its complex nature, the Turkish gas market has a track record of unimplemented regulations and policies. Therefore, it is crucial for the government to develop a more comprehensive and effective strategy that takes into account all aspects of market dynamics, including the complexities arising from new developments, past experiences, private sector players’ expectations while pursuing national interests, and the realities of the global natural gas market. With a solid commitment to implementation, the government could introduce this new approach through a Natural Gas Strategy Paper to all stakeholders.

This strategy paper should focus on the following key areas:

-

Predictability Of The Prices And Modern Support Mechanism

A clear gas sales pricing policy for all segments is essential. The pricing policy for industry and power plants should be market-based and predictable. The ongoing subsidy policy should be abolished, and a new modern support mechanism should cover only vulnerable customers rather than all households and small-medium enterprises. The new support mechanism should be designed based on the principles of optimum utilization of national reserves and fair distribution of wealth among citizens.

-

Clear Distribution Of Roles And Responsibilities

In order to ensure the security of natural gas supply and establish predictable market conditions, it is imperative to allocate the tasks and responsibilities between public and private sector entities. BOTAŞ may prolong the contracts for better terms with its negotiation power as a state entity. However, BOTAŞ' s gas sales and purchase policy should not impede private entrepreneurs from signing import contracts and supplying gas to clients, which will create liquidity and competition in the gas market. The year 2026 is crucial for the future of the gas market, and the new agreements should be signed based on the priorities set by the strategy paper. If Türkiye succeeds in establishing a reliable gas hub with a reputable gas benchmark price, the expired gas contracts could be renewed under more competitive terms.

-

Unbundling Of Botaş

BOTAŞ should be unbundled into separate modern enterprises, considering the national interests based on their respective functions. The European precedents (French ENGIE and GRTgaz or Italian ENI and SNAM) of unbundling and restructuring may guide Turkish policymakers in finding an optimum solution. The unbundling should not mean a total privatization of the state assets that may endanger national energy security. The unbundling of BOTAŞ should introduce function-oriented and efficient state-owned enterprises and a fair and transparent market system for all stakeholders.

-

Becoming A European Standard Gas Hub

The existing complexities may hinder Türkiye ' s ability to take full advantage of the opportunities presented by its geopolitical, economic, and technical capacities. Given the need for the Turkish gas hub to engage with the European gas market, its establishment must adhere to the principles set forth by European precedents. In this context, EFET' s European gas hub assessment criteria may guide policymakers in taking the necessary actions and modifications to Turkish gas market regulations and practices.

-

Decarbonization And Renewable Gas Policy

In order to achieve net zero targets for Türkiye by 2053, the efficient use of natural gas should be a primary objective for the consumption segments, which will also reduce import bills and contribute to the optimum use of national resources. As the Turkish natural gas system is younger than the European ones, utilizing the natural gas grid until its technical lifetime is essential for national interests. Therefore, to decarbonize the gas market, renewable gas should be supported with solid mechanisms prioritizing the hard-to-abate sectors of the industry that face CBAM mechanism risks of the EU. The biomethane potential of Türkiye should also be considered as a development area for the future decarbonization of the gas system.

Endnotes

[1] "Natural Gas Market 2023 Sector Report. " EMRA. Energy Market Regulatory Authority. Accessed June 10, 2024. https://www.epdk.gov.tr/Detay/Icerik/1- 1275/natural-gasreports.

[2] EUROSTAT. "Supply, Transformation, and Consumption of Gas. " Accessed April 15, 2024. https://ec.europa.eu/eurostat/databrowser/view/nrg_cb _gas/default/table?lang=en.

[3] TEIAS. "Türkiye Elektrik İstatistikleri. " Accessed June 10, 2024.https://ytbsbilgi.teias.gov.tr/ytbsbilgi/frm_istatisti kler.jsf.

[4] Ministry of Energy and Natural Resources of Türkiye. “93 yeni yerleşim yerini daha doğal gaz konforuyla tanıştırdık, ” January 5, 2024. Accessed April 27, 2024. https://enerji.gov.tr/haber-detay?id=21223 .

[5] "2022 Natural Gas Distribution Sector Report. " GAZBİR. GAZBİR - Natural Gas Distribution Companies Association of Türkiye, August 14, 2023. https://www.gazbir.org.tr/en/publications/89.

[6] "Türkiye National Energy Plan. " Republic of Türkiye Ministry of Energy and National Resources, 2022. https://enerji.gov.tr/Media/Dizin/EIGM/tr/Raporlar/TUEP /T%C3%BCrkiye_National_Energy_Plan.pdf.

[7] "Natural Gas Market Sector Reports of 2019, 2020, 2021, 2022 and 2023. " EMRA. Energy Market Regulatory Authority. Accessed June 10, 2024. https://www.epdk.gov.tr/Detay/Icerik/1-1275/natural- gasreports.

[8] "Gas Market Report, Q1-2023. " IEA. International Energy Agency, February 2023. https://www.iea.org/reports/gas-market-report-q1- 2023.[9] Fulwood, Mike. "A New Global Gas Order? (Part 1): The Outlook to 2030 after the Energy Crisis. " The Oxford Institute for Energy Studies, July 2023. https://www.oxfordenergy.org/publications/a-new- global-gas-order-part-1-the-outlook-to-2030-after-the- energy-crisis/.

[10] "Global Gas Security Review 2023. " IEA. International Energy Agency, July 2023. https://www.iea.org/reports/global-gas-security-review- 2023.

[11] "Hazine Bakanlığı, KİT'lerin görevlendirme olarak adlandırılan kaynak aktarım bilgilerini yayınladı. " EnerjiIQ 17, no. 588 (May 2, 2024): 10.

[12] Jégo, Marie. "President Erdogan ' s Grain Deal Is a Lesson in Diplomacy. " Le Monde. August 5, 2022. https://www.lemonde.fr/en/international/article/2022/0 8/05/president-erdogan-s-grain-deal-is-a-lesson-in- diplomacy_5992564_4.html.

[13] Arinc, Ibrahim S. "The Natural Gas Geopolitics of Turkey. " Doctoral Dissertation, Durham University, 2014

[14] "2024 Yılı Cumhurbaşkanlığı Yıllık Programı. " Presidency of the Republic of Türkiye, October 25, 2023. https://www.sbb.gov.tr/wp- content/uploads/2023/10/2024-Yili-Cumhurbaskanligi- Yillik-Programi.pdf

[15] GIIGNL Annual Report 2024. " GIIGNL, June 2024. https://giignl.org/wp-content/uploads/2024/06/GIIGNL- 2024-Annual-Report-1.pdf

[16] "Natural Gas Market Sector Reports of 2019, 2020, 2021, 2022 and 2023. " EMRA.

[17] "Natural Gas Market 2023 Sector Report. " EMRA.

[18] EFET. "2023 Review of Gas Hub Assessment. " Accessed May 14, 2024. https://www.efet.org/home/documents?id=19.

[19] European Commission. "EU Trade Relations with Türkiye. Facts, Figures and Latest Developments. " Accessed February 15, 2024. https://policy.trade.ec.europa.eu/eu-trade-relationships- country-and-region/countries-and-regions/turkiye_en.

[20] Acar, Sevil, Ahmet Atıl Aşıcı, and A. Erinç Yeldan. "Potential Effects of the EU' s Carbon Border Adjustment Mechanism on the Turkish Economy. " Environment, Development and Sustainability 24, no. 6 (August 31, 2021): 8162–94. https://doi.org/10.1007/s10668-021- 01779-1.

[21] Türkiye National Energy Plan. MENR

[22] AA. "Türkiye Announces National Energy Plan and Hydrogen Strategy, " January 19, 2023. https://www.aa.com.tr/en/economy/turkiye-announces- national-energy-plan-and-hydrogen- strategy/2791948#:~:text=Hydrogen%20Technologies%2 0Strategy%20and%20Roadmap, - Meanwhile%2C%20Donmez%20also&text=Starting%20fro m%202030%20until%20the,the%202050s%2C%22%20he %20said.

[23] Birman, Jessie, Julien Burdloff, Hugues De Peufeilhoux, Guillaume Erbs, Malo Feniou, and Pierre- Laurent Lucille. "Geographical Analysis of Biomethane Potential and Costs in Europe in 2050. " ENGIE. ENGIE, May 2021. https://www.engie.com/sites/default/files/assets/docu ments/2021- 07/ENGIE_20210618_Biogas_potential_and_costs_in_20 50_report_1.pdf.

[24] "Natural Gas Market Sector Report of 2023. " EMRA.

[25] "Convergence between Spot and Long-Term Gas Prices. " Enerji IQ 6, no. 577 (February 8, 2024): 2.

[26] Rzeyeva, Gulmira. "Türkiye ' s Supply-Demand Balance and Renewal of Its LTCs. " OIES. The Oxford Institute for Energy Studies, April 2022. https://www.oxfordenergy.org/wpcms/wp- content/uploads/2022/04/Insight-113-Turkeys-supply- demand-balance-and-renewal-of-its-LTCs.pdf .

[27] "Türkiye Starts Delivery of Natural Gas from Black Sea Field. " Enerji IQ - English, no. 194 (April 24, 2023): 4.

[28] "Preamble of Omnibus Bill No:7451. " Turkish Grand National Assembly, March 7, 2023. https://cdn.tbmm.gov.tr/KKBSPublicFile/D27/Y6/T2/We bOnergeMetni/bae9f6a3-880d-4d9a-aaca- 419909a40b9d.pdf.

About the author

DR. İBRAHİM SAİD ARINÇ is the CEO Advisor at SOCAR Turkey.

DISCLAIMER The author alone is responsible for the views expressed in this publication, which do not necessarily represent the views, decisions, or policies of his affiliation.

About center for international policy research

Center for International Policy Research (CIPR) is a research center with focus on economic, political, energy and security issues in the GCC region. Based in Doha, CIPR specializes in political risk analysis, government and corporate advisory, conflict advisory, track II diplomacy, humanitarian/development advisory, and event management in the GCC region and beyond. The CIPR aims at becoming a primary research and debate platform in the region with relevant publications, events, projects and media productions to nurture a comprehensive understanding of the intertwined affairs of this geography. With an inclusive, scholarly and innovative approach, the CIPR presents a platform where diverse voices from academia, business and policy world from both the region and the nation’s capital interact to produce distinct ideas and insights to the outstanding issues of the region.

Design and Layout: PYNA